|

Write us at info@downside.com

|

Downside®

old

news

| 2007 |

| 2007-10-32

- Oil at $94 |

Back in 2005, we predicted an oil crunch. Today, NYMEX crude hit $94, purely on demand, without any major supply disruption.

We weren't pessimistic enough.

Many of the things we predicted for 2006 happened in 2007. The mortgage meltdown and housing crash happened, a bit later than we expected. Chrysler was sold off at a bargain price.The Iraq war continues as a stalemate. |

| 2007-09-12

- Where are they now? Behind bars. |

Federal

Bureau of Prisons Inmate Locator

Inmate Information for

BERNARD J EBBERS |

|

Inmate Register Number |

56022-054 |

| Name |

BERNARD J EBBERS |

| Age |

66 |

| Race |

WHITE |

| Sex |

MALE |

| Projected

Release Date |

07-04-2028 |

| Location |

OAKDALE FCI |

|

Bernie Ebbers, former CEO of Worldcom. Serving 25 years in Federal prison in Louisiana.

Responsible for the largest known single-business investor loss due to fraud, $180 billion. |

Federal

Bureau of Prisons Inmate Locator

Inmate Information for

RICHARD A CAUSEY |

|

Inmate Register Number |

29261-179 |

| Name |

RICHARD A CAUSEY |

| Age |

47 |

| Race |

WHITE |

| Sex |

MALE |

| Projected

Release Date |

10-16-2011 |

| Location |

BASTROP FCI |

|

Enron's former Chief Accounting Officer, in charge of the "creative accounting" that hid Enron's losses.

|

Federal

Bureau of Prisons Inmate Locator

Inmate Information for

JEFFREY K SKILLING |

|

Inmate Register Number |

29296-179 |

| Name |

JEFFREY K SKILLING |

| Age |

53 |

| Race |

WHITE |

| Sex |

MALE |

| Projected

Release Date |

02-21-2028 |

| Location |

WASECA FCI |

|

Enron's former CEO, Jeff Skilling, is in Federal prison in Minnesota. |

|

| 2007-08-26

- Notes on the current crises |

We have been working on another data-mining project, SiteTruth, which does automated due diligence on the businesses behind web sites. That's why Downside hasn't been updated in recent months. The real reason we don't have much to say about the current market negatives is that we don't have enough information to evaluate them.

Debt markets don't have enough transparency for fundamental analysis. We predicted, over a year ago, "Homeowners with adjustable-rate interest-only loans default and are foreclosed. Housing prices crash as foreclosures glut market." We were right. It was obvious that something had to break. What wasn't obvious was the failure mode. We had no idea who the counterparties in all those mortgage based hedges were, though. Neither did anyone else, including, apparently, top management of some of the parties.

A comment on derivatives generally: no linear combination of bets can produce an expectation higher than the highest expectation of any of the bets. This is why casino "betting systems" don't work. Derivatives are usually linear combinations of bets. Derivatives thus do not have higher expectations than their components. The basic effect of derivatives is to reshape the expectation vs. probability curve, typically to yield a high probability of a moderate gain coupled with a small probability of a large loss.

Remember "portfolio insurance"? Long Term Capital Management? They entered the inescapable "small probability of large loss" region. This time it's the "25 sigma event" in Goldman Sachs hedge funds. |

| 2006 |

| 2006-12-31

- 2006 predictions recap |

We finish the year by looking back at the predictions from the beginning of the year.

- Saudi

Arabia finally admits the Gawar field has peaked. Oil passes

$70 per barrel.Oil did pass $70/bbl, and has been trading in the $60/$70 range since. Close for the year at $61.05. But the Saudis say Gawar has not peaked.

- US

interest rate spike. "Homeowners" with adjustable-rate interest-only

loans default and are foreclosed. Housing prices crash as

foreclosures glut market.

No interest rate spike. Foreclosures are up and housing prices down, but not to the level of a crash.

- Nobody

wins in Iraq. Neither side can force a decision, so both

sides keep bleeding.

That's what happened.

- One

of the big three US car manufacturers goes bankrupt.

Both GM and Ford are in terrible shape, mergers have been discussed, and Delphi went bankrupt, but GM and Ford are hanging on.

- A

major hurricane wipes out another southern US city.

Totally wrong. Very slow hurricane season.

|

| 2006-10-16

- Andrew Fastow behind bars |

Federal

Bureau of Prisons Inmate Locator

Inmate Information for

ANDREW STUART FASTOW |

|

Inmate Register Number |

14343-179 |

| Name |

ANDREW

STUART FASTOW |

| Age |

44 |

| Race |

WHITE |

| Sex |

MALE |

| Projected

Release Date |

UNKNOWN |

| Location |

HOUSTON

FDC |

|

Andrew

Fastow, the primary architect of the Enron debacle,

is now safely behind bars.

Ken

Lay, of course, is dead.

Sentencing

for Enron's Jeff Skilling is scheduled for October 23,

2006. Sentencing for Richard Causey is pending. Once

those two are in prison, it's over.

|

|

| 2006-10-08

- There's a new member of the club |

|

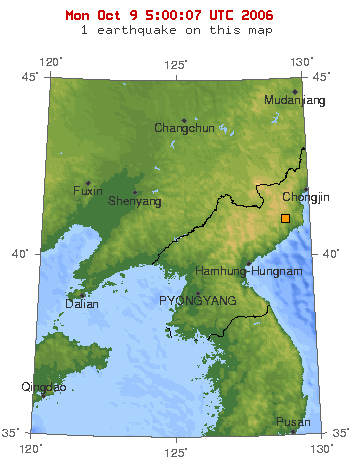

USGS

automatic earthquake monitoring system report. |

|

| 2006-09-03

- Drop and give me 20 |

As our

contribution to reducing America's obesity epidemic, Downside

offers the Youth Fitness

Song. This song was commissioned by the President's Council

on Youth Fitness during the Kennedy administration. A record

with this song was sent by the U.S. Government to every school

in America, to be played over the public address system each

morning, while students exercised. It's past time to revive

this. |

| 2006-08-09

- Oil and war |

With

the shutdown of Prudhoe Bay production for pipeline repair,

and threats from Iran to use the "oil weapon", we

are about to find out if Saudi Arabia has the extra production

capacity they claim.

When

Saudi Arabia runs out of extra capacity, any major OPEC country

can force a worldwide oil shortage. The 1973 embargo required

coordination amongst the OPEC countries. Next time, individual

members will have that power. Political events will determine

if it is used, and against whom. |

| 2006-07-01

- Downside's predictions at midyear |

At midyear,

it is time to review our predictions from the beginning of

the year:

- Saudi

Arabia finally admits the Gawar field has peaked. Oil passes

$70 per barrel.

Oil

hit $75 per barrel and remains above $70. The Saudis still

don't publicly admit that Ghawar has peaked, although there

have been hints.

- US

interest rate spike. "Homeowners" with adjustable-rate interest-only

loans default and are foreclosed. Housing prices crash as

foreclosures glut market.

Interest

rates continue to go up, at the Fed's "measured pace",

but no spike or housing collapse.

- Nobody

wins in Iraq. Neither side can force a decision, so both

sides keep bleeding.

That

statement continues to describe the war.

- One

of the big three US car manufacturers goes bankrupt.

GM

is about to be bought out at a very low price, and Ford's

bonds are at junk status.

- A

major hurricane wipes out another southern US city.

Hurricane

season has just started.

We see

no need to change the predictions. |

| 2006-05-25

- Oil production flat |

|

| 2006-05-25

- Guilty, Guilty, Guilty |

Ken Lay

- guilty on all counts. Jeffrey Skilling - guilty on all securities-fraud

counts. Thus ends the Enron debacle.

Neither

is actually in jail yet. Sentencing is set for September 11,

2006. Few of the Enron criminals have started doing their

time yet. That will change now that they are no longer needed

as witnesses. |

| 2006-04-21

- Oil at $75 |

At the

beginning of this year, we predicted "Saudi Arabia

finally admits the Ghawar field has peaked. Oil passes $70

per barrel." Oil has been above $70 for most of the

week. We're there.

No traumatic

events are currently affecting production. No wars. No sabotage.

No embargoes. This is pure lack of capacity. Economically,

"peak oil" seems to be here.

The Saudis

still aren't admitting that Ghawar has peaked. Many suspect,

but few know. Mexico does admit that their biggest field,

the Cantarell, peaked in 2005, and Kuwait has admitted that

their biggest field also peaked in 2005. So two of the big

three have peaked.

The higher

prices are not yet significantly affecting demand in the developed

world. That takes time. The combination of limited elasticity

on the demand side and limits on the supply side imply further

price rises. |

| 2006-04-14

- Downside at 5 |

Five

years ago we started Downside. We were right about the dot-com

crash; it was worse than even we expected. This year we're

predicting trouble due to short oil supplies, too much debt,

and cllimate change.

The problems

the US faces are technically solveable, but we do not yet

see the political will to admit the problems, let alone solve

them. |

| 2006-01-11

- Skilling and Lay on trial |

"This

is a criminal case. The defendants are Mr. Jeffrey Skilling

and Mr. Ken Lay." With those words, the trial of the former

top people at Enron began today. Skilling and Lay may take

the position that they didn't know what was going on (the

"idiot defense"). They may try to blame Fastow,

the former CFO. They may try to argue that Enron was a legitimate

business run into the ground by the people below them. With

eighteen Enron executives already convicted, none of those

defenses are likely to work.

Q:

When we talked as you were becoming CEO, I asked you

what setbacks or failures you'd ever had in your life.

You said none. Do you consider this to be your first

failure?

A:

Maybe this will sound awful, but I don't. I remember

when there were three of us on the 39th floor at Enron,

when we got this whole nonregulated side of the business

going. Like I said, I am very proud of what I and others

accomplished at Enron. We built a company that, 10 years

from now, 20 years from now, is going to be a factor

to be reckoned with. I can probably say I have no regrets.

-

Skilling interview in Business Week, August 2001 |

|

| 2006-01-11

- Why interest rates are so low |

| Interest

rates are still low by historical standards. This is because

China is buying far more low-paying US treasury paper than makes

economic sense. This is part of a deal with the Bush Administration - the US doesn't erect trade

barriers against China's products, and China doesn't pull their

money out of the US. This deal makes possible high deficits

and tax cuts without financial collapse.

If China

pulls their $250 billion out of US Treasuries, or even stops

further Treasury purchases, interest rates will go up. If

mortgage rates go up, the speculators who have interest-only

loans with adjustable rates see their payments rise. Many

will default, resulting in foreclosure. The housing bubble

finally pops. Baby boomers who expect to sell their houses

at a profit lose their equity.

China

has not made significant US Treasury purchases in the last

six months. China has stopped financing the US deficit.

CNN reported on January 6th that China

is discussing moving its foreign exchange reserves out of

US Treasuries. This is significant.

The government

of China has been using this economic power for political,

rather than economic leverage. This statement

by Zheng Bijian, a recent member of the Central Committee

of the Communist Party of China, in People's Daily, the official

organ of the Chinese government, is worth a close reading.

This outlines the political conditions for continued economic

support of the United States. The style is diplomatic and

oblique. It is clear, though, that China sees itself as being

in a position to dictate terms. Which China is. China now

has the power to pull the plug on the US economy at modest

cost to themselves. Actions here will be politically, not

economically motivated, so we cannot make any predictions.

We should expect, though, that any significant political disagreement

between the US and China will result in a rise in US interest

rates.

It's

now necessary to follow the statements of the People's

Bank of China as closely as one follows those of the US

Federal Reserve. |

| 2006-01-09

- The foreclosure trap |

|

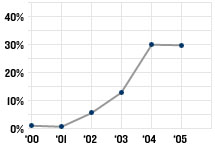

Interest-only

loans as a percentage of new loans.

(Data from Loan performance)

People

with these loans are not homeowners. They're renters,

with an option to buy. One interest-rate spike and they're

out on the street. |

|

| 2006-01-01

- Predictions for 2006 |

Consistent

with our tradition of pointing out obvious negatives, we offer

the following predictions for 2006:

- Saudi

Arabia finally admits the Gawar field has peaked. Oil passes

$70 per barrel.

- US

interest rate spike. "Homeowners" with adjustable-rate interest-only

loans default and are foreclosed. Housing prices crash as

foreclosures glut market..

- Nobody

wins in Iraq. Neither side can force a decision, so both

sides keep bleeding.

- One

of the big three US car manufacturers goes bankrupt.

- A

major hurricane wipes out another southern US city.

Happy

New Year. |

| 2005 |

| 2005-12-28

- Richard Causey pleads guilty, cuts deal |

|

Richard

Causey, formerly Enron's chief accounting officer, has

agreed to plead guilty and cooperate with prosecutors.

Just in time for the trials of Skilling and Lay next

month.

Movie

recommendation: Fun with Dick and Jane. If you've

followed the Enron debacle closely, you'll recognize

some scenes. And check the ending credits. |

|

| 2005-12-12

- Kuwait's largest field just peaked, early |

| The

second largest oil field in the world, the Burgan field in Kuwait, just

peaked, years earlier than expected. The reserve numbers

from OPEC countries have been known to be overly optimistic

for years. Reality is now intruding. |

| 2005-05-22

- Oil |

|

June

2005 oil futures

(NYMEX) |

From

a fundamentalist perspective, oil is now the major driver

of the economy. We will thus have more to say about oil from

now on.

Keep

these points in mind when looking at the chart above.

- Oil

demand is only weakly elastic in the short term on the demand

side. On the supply side, only Saudi Arabia had excess capacity,

and they are now at maximum output.

- Capacity

increases slowly. Reserves are not increasing at all. Demand

is increasing steadily.

- Large,

short-term price swings are to be expected, because supply

and demand are both closely matched and inelastic. Watch

the annual price trend, not the daily variations. Press

reports focusing on small day to day changes are not significant.

Read "Beyond Oil",

by a Shell petroleum geologist who knows something about the

subject. |

| 2005-03-15

- Bernie Ebbers convicted |

|

Bernie

Ebbers, who led Worldcom into the tank, was convicted

today for his role in the biggest fraud and bankruptcy

in all of history. As the indictment puts it, "from

in or about September 2000 through in or about June

2002, BERNARD J. EBBERS, Scott D. Sullivan,and their

co-conspirators engaged in an illegal scheme to deceive

members of the investing public, WorldCom shareholders,securities

analysts, the SEC, and others, concerning WorldCom ’s

true operating performance and financial results."

Worldcom's MCI unit was the source of the "Internet

traffic is doubling every 100 days" statement that

fueled the dot-com boom, and that false statement was

part of that fraud scheme. |

|

|

|

|

| 2004-10-11

- The weakening dollar |

|

Dollars

per euro, 2004. |

The

Federal deficit doesn't mean free money for the Government.

There's a price to be paid. |

| 2004-10-11

- The coming mortgage crunch |

|

The

next crash looks to be housing-related. Fannie Mae is

in trouble. But not because of their accounting irregularities.

The problem is more fundamental. They borrow short,

lend long, and paper over the resulting interest rate

risk with derivatives. In a credit crunch, the counterparties

will be squeezed hard. The numbers are huge. And there's

no public record of who those counterparties are.

Derivatives

allow the creation of securities with a low probability

of loss coupled with a very high but unlikely loss.

When unlikely events are uncorrected, as with domestic

fire insurance, this is a viable model. When unlikely

events are correlated, as with interest rate risk, everything

breaks at once. Remember "portfolio insurance"?

Same problem.

Mortgage

financing is so tied to public policy that predictions

based on fundamentals are not possible. All we can do

is to point out that huge stresses are accumulating

in that sector. At some point, as interest rates increase,

something will break in a big way. The result may look

like the 1980s S&L debacle. |

| 2004-07-08

- Kenneth Lay arrested |

|

Kenneth

Lay, the former Enron CEO, has finally been arrested.

He claims he didn't know his company was a Ponzi

scheme.

Glisan

gave up Fastow. Fastow gave up Skilling and Lay.

Will Lay give up Bush? |

|

| 2004-06-22

- Spam purporting to be from Downside |

|

An

unknown party has been using the Downside name to promote

a stock. The stock being promoted is XcelPlus (XLPI.PK).

We are not involved with this promotion, and our name

is being forged by the promoter.

A

quick look at XLPI shows it to be a thinly traded penny

stock in the Pink Sheets. The company, "Xcelplus

International Inc.", is a Virginia corporation.

It does not appear to be registered with the SEC, despite

being publicly traded and promoted to the public. This

is highly suspicious. We have notified the SEC. |

| 2004-06-16

- Lea Fastow behind bars |

|

Federal

Bureau of Prisons Inmate Locator

Inmate Information for LEA W FASTOW |

|

Inmate Register Number |

20290-179 |

|

Name |

LEA W FASTOW |

| Age |

42 |

| Race |

WHITE |

| Sex

|

FEMALE |

| Projected

Release Date |

UNKNOWN |

| Location |

IN

TRANSIT |

|

Two

down, more to follow.

Next,

Enron CFO Andrew Fastow. Convicted but still on

the street. Skilling has been indicted, with a

trial to come. |

|

| 2004-05-16

- Non-flying cars |

| The

Moller Skycar from

Moller

Corporation has been in the news recently. We have

some negative information

about that company. As the SEC put it in their fraud complaint,

"As of late 2002, MI's approximately 40 years of

development has resulted in a prototype Skycar capable

of hovering about fifteen feet above the ground." |

| 2004-04-14

- Downside at four |

Four

years ago today, we started Downside. We had this to say:

|

2000-04-14

- Today begins the Second Great Depression

All

bubbles burst. This one just did. The great Internet

bubble is over.

First we had Internet companies with no profits.

Then we had Internet companies with no revenue.

Towards the end, we saw attempts to take public

Internet companies with no operations. It had

to end, and it just did. This is healthy. It's

not the end of the Internet, just the end of the

stupidity. Now we have to get through a return

to reality. "Reality", in this context, is a return

to historical P/E ratios, in the 6 to 20 range.

What about the companies with no earnings? Uh

oh. Losing money on every sale and making it up

on volume is a joke, not a business plan. |

We

said that Internet stocks were insanely overpriced.

We said that the market as a whole was 2 to 3 times

higher than it should be. We said that the bubble would

burst sooner, rather than later. We were hated and derided

as pessimists. We were right.

The

last year has brought some recovery. But equity prices

are still far too high by historical standards.

Compare

the US situation with that in Japan, where the equity

bubble peaked in 1989. In Japan, as in the US today,

Government policies were put in place to prevent equities

from dropping to their proper level. Interest rates

were kept artificially low. So what happened in Japan?

|

|

|

20

years of the Nikkei 225 index |

Sometimes,

they don't come back. |

| 2004-02-18

- Enron's Skilling indicted |

|

Jeff

Skilling, Enron's former CEO, was indicted

today. Finally. While

there are apologists for Skilling, as CEO, he knew,

or should have known, that his company was a Ponzi scheme.

Will

Ken Lay be indicted? That gets close to Bush, and just

in time for election season. |

| 2004-02-12

- Enron Treasurer in prison |

|

Federal

Bureau of Prisons Inmate Locator

Inmate Information for BEN F GLISAN |

|

Inmate Register Number |

20293-179 |

|

Name |

BEN

F GLISAN |

| Age |

38 |

| Race |

WHITE |

| Sex

|

MALE |

| Projected

Release Date |

1/17/2008 |

| Location |

HOUSTON

FDC |

|

After

much delay, the first Enron executive is safely

behind bars.

Next

to go to jail will be former Enron CFO Andrew

Fastow. Fastow, although he pled guilty, is currently

"out on bail awaiting sentencing" until

April. He's "cooperating with prosecutors"

to get some time knocked off his sentence. As

a result, former

Enron CEO Jeff Skilling is scheduled

to be indicted next week. |

|

2003

|

| 2003-12-06

- Job losses continue |

|

The

current US "recovery" doesn't include jobs.

|

|

Job

gains/losses, by U.S. President

Source: U.S. Bureau of Labor Statistics, AFL-CIO |

Eighty

percent of new US jobs last month were in the low-paying

"temporary", "heath care and social assistance",

and "food services and accommodations" categories.

Manufacturing and engineering jobs continue to decline.

As the New

York Fed analyzes this psuedo-recovery, "The

job losses associated with cyclical shocks are temporary:

at the end of the recession, industries rebound and

laid off workers are recalled to their old firms or

readily find comparable employment with another firm.

Job losses that stem from structural changes are permanent." |

| 2003-10-10

- Enron's chief accounting officer flips |

|

Wesley

H. Colwell, the former chief accounting officer of Enron

North America, has cut

a deal to escape prosecution.

He agreed to "continue to cooperate with on-going

investigations into Enron Corp. by the Securities and

Exchange Commission and the U.S. Department of Justice

Enron Task Force".

Colwell,

as chief inside accountant, appears to have been responsible

for the mechanics of Enron fake earnings inflation.

He should know where all the bodies are buried. Colwell

will presumably appear as a witness for the prosecution

in the Fastow case. The main question at this point

is whether Cowell has given enough information to prosecute

Skilling and Lay. |

| 2003-09-23

- Enron update: more indictments |

|

Three

senior Merrill employees involved in Enron's earnings

deception were indicted

last week. Merrill, once a highly respected Wall Street

brokerage, was directly involved in assisting Enron's

accounting frauds.While Merrill previously denied wrongdoing,

they have now entered into a cooperation agreement with

the FBI. |

| 2003-09-10

- Enron update: guilty, guilty, guilty |

|

Former

Enron treasurer Ben Glisan pled guilty today and was

sentenced to five years in the pen. Glisan admitted

that "he and others engaged in a conspiracy to

manipulate artificially Enron's financial statements".

This follows the conviction of Enron exec Michael Kopper.

Next up, Enron CFO Andrew Fastow, scheduled for trial

next spring on charges that could lead to a life sentence.

Still being investigated are former CEOs Kenneth Lay

and Jeff Skilling. The known connection between Lay

and Bush is being avoided, but if Lay goes down, he

might take Bush down with him.

Secret

hearings in the Fastow case indicate activity on

that front. Keep watching. |

| 2003-06-30

- The post-bubble bubble |

|

Why

hasn't all the air come out of the market bubble yet?

In the June 28th issue of The Economist, (p. 25), we

read this: "The

Fed, it seems, will stop at nothing to keep the post-bubble

economy afloat. ... After playing an key role in nurturing

the equity bubble of the late 1990s by holding down

interest rates, it has since propped up the economy

by furthering first a property bubble and then a bond

bubble." This

article is worth a close read.

The

Fed can do no more. Interest rates are almost zero.

What

we're seeing looks like a replay of the Japan of the

1990s. The Nikkei peaked in 1989, around 39000, before

Japan's crash in that year. Government policy was manipulated

to keep the market up. Interest rates went to near zero.

It didn't help. A decade later, the Nikkei is around

9100. |

| 2003-06-26

- The bottom is still a long way down |

| There's

loose talk going around that the depression in the market

is over. Wrong. Stock prices are still far too high for

earnings

We

last showed this DecisionPoint

chart in July 2002. A year later, the P/E ratio for

the S&P 500 is 33.22, down from 34.07 last summer.

Normal P/E ratios for the entire market are between

10 and 20.Whenever the black line is above the red line,

stocks are overpriced.

Over

time, earnings usually increase, but that's a slow process.

It would take a decade of ordinary earnings growth to

bring the red line up to meet the black line. The earnings

bubble of 2000-2001 was just that, a bubble. Some of

those earnings were faked, as we now well know.

Yes,

the momentum investors are back, fueled by the usual

televised hype. That's gambling, not investing. |

| 2003-05-01

- More Enron indictments |

|

More

indictments

in the Enron case today. Money laundering, wire fraud,

bank fraud, filing false tax returns, insider trading,

falsification of records... Fastow, of course, was indicted

again, along with six others. From the indictment:

"Between at least 1996 and November 2001, FASTOW,

GLISAN, BOYLE and other devised various schemes to defraud

Enron and its shareholders, the investing public, the

SEC, and others. ... fradulent manipulation of Enron's

financial results ... manipulation of the share price

... appearance of business skill ... personal enrichment

... filing false and misleading statements with the

SEC ... false and misleading public statements".

On

August 24, 2001, Ken Lay said this in a Business

Week interview: "There are absolutely no

problems that had anything to do with Jeff's departure.

There are no accounting issues, no trading issues, no

reserve issues, no previously unknown problem issues.

The company is probably in the strongest and best shape

that it has ever been in." Less than four months

later Enron was bankrupt. So far, Ken Lay and Jeff Skilling

haven't been charged, but that may yet happen. |

| 2003-04-26

- TV Turnoff Week |

|

This

is National TV Turnoff

Week. While that event may seem an exercise in futility,

Downside readers should recognize that heavy television

viewing is negatively correlated with income.

The

scandals continue. Frank Quattrone, who put Credit Suisse

First Boston into the overhyped IPO business, was arrested

this week for ordering the shredding of incriminating

documents. WorldCom's former CFO, Scott Sullivan, was

indicted

for bank fraud, in addition to previous indictments

related to WorldCom's bankruptcy. Further indictments

in the Enron cases are expected next week. It's not

over. |

| 2003-04-14

- Downside at 3 |

Three

years ago today, we started Downside. We had this to say:

|

2000-04-14

- Today begins the Second Great Depression

All

bubbles burst. This one just did. The great Internet

bubble is over.

First we had Internet companies with no profits.

Then we had Internet companies with no revenue.

Towards the end, we saw attempts to take public

Internet companies with no operations. It had

to end, and it just did. This is healthy. It's

not the end of the Internet, just the end of the

stupidity. Now we have to get through a return

to reality. "Reality", in this context, is a return

to historical P/E ratios, in the 6 to 20 range.

What about the companies with no earnings? Uh

oh. Losing money on every sale and making it up

on volume is a joke, not a business plan. |

We

said that Internet stocks were insanely overpriced. We

said that the market as a whole was 2 to 3 times higher

than it should be. We said that the bubble would burst

sooner, rather than later. We were hated and derided as

pessimists. We were right.

In

retrospect, we weren't pessimistic enough. We didn't

realize the extent to which even "value" stocks

were overpriced. We didn't see the extent of accounting

fraud. We didn't anticipate the biggest bankruptcies

in history.

In the First Great Depression, the financial community

was in denial for about three years. We are now three

years into the Second Great Depression. It's just started

to be accepted that things won't get better any time

soon. Reality is finally sinking in.

What

ended the First Great Depression? Not the war, but the

technical advancements that came from it. No new technology

is poised to have a similar impact in the next few years.

We may be stuck until some truly new ideas come along.

|

| 2003-03-23

- The first casualty of war |

| ...

is truth. News reporting on this war is rather tightly

controlled. Note that most lead stories are based on official

statements by one side or the other. What's not being

said is perhaps more important than what is being said.

Over the next few weeks, as reporters start gathering

information on their own, the quality of the reporting

will improve. For now, a degree of skepticism should be

maintained. The fog of war is quite real. |

| 2003-03-13

- Spam |

|

Spam with a return address on "downside.com",

advertising a pornography site, did not come from us.

We are in the process of tracing the forger via their

payment service.

Downside®

is a registered trademark. |

| 2003-03-08

- Don't bunch up |

|

On

the eve of war, the traditional infantry advice, "don't

bunch up" is appropriate. If

Iraq does have weapons of mass destruction, we're about

to find out the hard way. Don't assume that a war with

Iraq will be entirely "over there". It's a

good time to get out of the obvious target areas, like

lower Manhattan and downtown Washington. Massive destruction

is unlikely, but substantial disruption is quite possible.

Last time, the war was about pushing Iraq out of Kuwait.

Iraq's survival as a country wasn't threatened. This

time, it is. There's no reason for Iraq to hold back

if the US bombs Baghdad.

From

a financial perspective, it would be prudent to assume

that the financial system might go down for a few days

or weeks. Any option, derivative or hedge which requires

functioning markets and liquidity is risky in this environment.

Hard

copies of account statements will become important if

key systems are disrupted. Be prepared for ATM and credit

card processing outages.

It

might be a short, victorious war. War may be avoided.

Or not. Better safe than sorry. |

| 2003-03-02

- Where are they now? |

|

Moving

to tax havens didn't help those companies. They're all

bankrupt. Excessive mucking about with the financial structure

seldom bodes well for the stockholders, although management

may benefit. |

| 2003-02-12

- On becoming the conventional wisdom |

|

CNN

now sounds gloomier than we do. But for the wrong

reasons. Bear in mind that P/E ratios are still

far too high by historical standards. The bubble still

hasn't fully deflated. It may take several more years,

perhaps longer, to reach the bottom. In the first great

depression, P/E ratios bottomed out around 10. A comparable

ratio today would put the S&P 500 around 250, down

from 818 today. The climb back took decades last time.

That's a pessimistic estimate, but it might not be wrong.

One

could take the position that the bottom will only see

P/E ratios at a historically high value of 20, that

earnings will recover in the near term, and that none

of the current and upcoming wars will badly hurt the

US. That yields an S&P 500 value of maybe 600-700,

still well below current values, for a very optimistic

set of assumptions. |

|

| 2002

Q4 |

| 2002-12-25

- Bah. Humbug! |

|

The stock

market has now had three down years in a row. Only twice in

the last century has that happened, most recently in the early

1940s, and, of course in the first Great Depression. Yet price/earnings

ratios remain high by historical standards. The bottom is

still a long way down from here.

Retail

was slow this season, which shouldn't surprise anybody.

Much

has been made of increased productivity in recent months.

That's not an indicator of economic growth. Productivity rises

in a recession, simply because the least efficient producers

and plants shut down first.

We have

a war with Iraq coming up, al-Queda is still active, and the

Administration is putting in comprehensive Big Brother systems.

Happy

holidays. |

| 2002-12-08

- Insiders vs. stockholders |

|

The San

Jose Mercury News, as their top story today, today provided

a list of 40 companies whose top management made hundreds

of millions of dollars selling their stock before the company

tanked. The top five:

This

is marginally legal under current US law, but stockholder

lawsuits are definitely indicated. The presence of any officer

or director of any of those companies in management of another

company should be regarded as a sell signal. In some European

countries, those people would be barred by law from a management

role in a public company for life.

As we've

been saying for some time, the current system of compensation

by short-term stock options rewards management for volatility,

not long-term profitability. We need longer holding periods,

much longer ones. Management must be at risk of loss if the

company tanks.

|

| 2002-12-07

- Bush fires Lawrence Lindsey |

|

President

Bush has fired Lawrence Lindsey, his chief economic adviser

and former Enron director. Better late than never.

Meanwhile,

United Airlines is expected to go bankrupt tomorrow. Most

major analysts issued "sell" recommendations a month

or two ago, a contrast to the dot-com era, when we'd see "buy'

recommendations right up to the bankruptcy. Happy-talk analysis

seems to be out of fashion. |

| 2002-11-17

- Scandal updates |

|

Enron's

Fastow was arrested a few weeks ago, but pled not guilty.

It may take a while longer to get to Ken Lay.

It's

now come out that Williams Energy shut down power plants during

California's energy crisis to drive up prices.

Pitt

and Webster are gone from the SEC, but haven't yet been replaced.

It matters who replaces them. If it's somebody with a history

of putting crooks in jail, the mess may get cleaned up. If

not, the problems will continue. |

| 2002-10-20

- Enron - how high will the prosecutions go? |

|

The Enron

investigation continues to move up the food chain. The prosecutors

are working this like an organized crime case, which it is.

First, Enron exec Michael Kopper was arrested in September.

He provided information about Andrew Fastow, Kopper's boss

and the architect of Enron's offshore entities for creating

fake earnings. Fastow was arrested a few weeks ago. In turn,

Fastow can probably give up Ken Lay and some of Enron's board

members. They had to know what was going on; that's clear

from the board minutes that have been published.

But will

it stop there? Many Bush Administration people had strong

ties to Enron. Vice President Cheney's connection, of course,

is well known. Some less-prominent officials are now trying

to hide their Enron ties. The U.S. Trade Representative, Robert

B. Zoellick, has removed his connection with Enron from his

official

biography. (Compare this

archived version from 2001. Note the disappearance of

the sentence "Mr. Zoellick was a board member of Alliance

Capital, Said Holdings, and Jones Intercable, and served on

the Advisory Council of Enron Corporation.") Lawrence

Lindsey, Assistant to the President for Economic Policy, also

doesn't mention in his official

biography that he was a director

of Enron. Mr. Lindsey is the Administrations's leading

advocate of tax cuts as a solution to most economic problems. |

| 2002

Q3 |

| 2002-09-18

- Tyco CEO headed for Ryker's Island Jail |

|

Tyco's

former CEO, L. Dennis Kozlowski, goes to jail tomorrow. He

can't make the $10 million bail; his assets have been frozen

as ill-gotten gains of criminal activity. Kozlowski is the

first CEO of a Fortune 500 company to be jailed for business

crimes in recent years. More will follow.

Some

General Electric top executives were jailed for price-fixing

in the 1960s, which had a salutary effect on the rest of the

CEO community that lasted a decade. A few CEO convictions

with long jail sentences will go a long way to turn things

around.

In other

news, documents obtained from Enron litigation now indicate

that Enron had a larger role in California's power crisis

than previously believed. That scandal may be moving to the

front burner.

|

| 2002-09-16

- So many frauds, so little time |

|

That's

just a sampling of recent news stories. There's more to this

mess.

Recommended

reading:

How Companies Lie,

a bitter little book that's not wrong. Valuable insights

into the extent of the problem.

Anatomy of Greed,

a fun read from an Enron insider.

DownTime, a Guide to Federal

Incarceration - suggested as a gift for your least favorite

CEO.

|

| 2002-08-21

- Enron exec pleads guilty, agrees to cooperate with investigation |

|

Today,

Michael Kopper, a former Enron financial executive, pled

guilty to conspiracy to commit wire fraud and conspiracy to

commit money laundering. Kopper agreed, as part of his

plea bargain, to cooperate with investigators. Kopper knew

where the bodies were buried; he helped Andrew Fastow, Enron's

former CFO, construct all those deceptive off-balance entities

Enron used to fake revenue. Note

Kopper's position: he's pled guilty, but the sentence will

be determined by how well he cooperates. This is standard

procedure in organized crime cases, but it's not common in

fraud cases. But then, this was organized crime.

Now

the rest of Enron's crooks will go down. Fastow, at least,

Ken Lay, probably. Maybe some Andersen people, too; Andersen

was in on the planning of those off-balance entities.

|

| 2002-08-01

- Criminal investigation of AOL Time Warner |

|

The Justice

Department has opened a criminal investigation of AOL

Time Warner. It appears likely that there were phony earnings

reports and fake deals designed to exaggerate revenue.

AOL

was already in trouble for bad financial reporting. The

company was fined $3.5 million back in 2000 for capitalizing

the cost of those ubiquitous AOL disks. AOL is under a cease-and-desist

order from the Securities and Exchange Commission. That apparently

wasn't a strong enough sanction to make management stop.

Who's

next? Probably the brokerage

firms and banks that made the Enron debacle possible.

|

| 2002-07-27

- Executive arrests expected in WorldCom case |

|

WorldCom

executives will be charged next week, reports the Wall

Street Journal. The former CFO, controller, and probably the

former CEO are to be charged with fraud. Now we're getting

somewhere. Arrests in all the major cases are needed to restore

confidence in the markets.

In many

of these big financial fraud cases, it's clear that there

was illegal activity in top management, but it's been hard

to tell from the outside who knew what when. The Justice Department

has been hesitant to indict executives without a "smoking

gun" clearly establishing individual guilt before the

indictment. But that's not required. Big financial frauds

are a form of organized crime, and should be treated as such.

|

| 2002-07-24

- First mass arrest of executives of a failed company |

| Five

members of Adelphia's former management team were arrested today

on federal fraud charges. Each was charged with conspiracy,

securities fraud, wire fraud, and bank fraud. A bit late, but

a step in the right direction. |

| 2002-07-22

- Where's the bottom? A long, long way down. |

|

We've

been harping on this for a while now, but it's worth saying

again: The market is still overvalued. The history of P/E

ratios shows just how overvalued the market remains. Even

with the dot-coms gone and all the big bankruptcies, stock

prices remain far too high. P/E ratios remain higher, far

higher, than they have ever been in the entire history of

the U.S. stock markets. The black line has to come down to

the neighborhood of the blue line.

Chart courtesy of Decisionpoint.com.

|

| 2002-07-20

- WorldCom bankruptcy |

|

WorldCom

to declare bankruptcy Sunday.

This is the largest bankruptcy ever. There's not much more

to say.

Markets

are still far too high based on fundamentals. See "Stop

this Dream", in the Economist for July 20, 2002.

We've been saying that here for some time, but now it's a

mainstream position. "The postwar average P/E for the

S&P 500 is 15; now it is 40", writes the Economist.

So the S&P 500 needs to drop to around 340 (from 848 today)

just to get back to the postwar average. That's an average;

at times P/E ratios are lower. There are periods when prices

are so low that some companies sell below book value. When

bubbles collapse, they usually collapse all the way. So the

market bottom may be below that average. Again, the bottom

is a long way down.

|

| 2002-07-14

- "This is Fraud 101". |

|

"This

is way beyond aggressive accounting. This is Fraud 101, you

know, basic illegal conduct." - Congressman Tauzin

on WorldCom. Still no arrests, an indication that the Administration's

"get-tough" policy remains cosmetic.

|

| 2002-07-10

- Faith-based investing |

|

"All

investment is an act of faith, and faith is earned by integrity."

- from a recent Bush speech. When

the integrity goes away, so does the investment. But speeches

won't help. Tough audits and long jail sentences will. There

haven't been any CEO arrests yet. The "crackdown"

is, thus far, not seriously hurting the people who perpetrated

these frauds.

We're

not seeing companies selling below book value yet. P/E ratios

are still too high. We're nowhere near the bottom.

Remember,

the true value of a stock is the present value of its future

dividends. Anything above that is based on the assumption

that there's a "greater fool" willing to buy the

stock. Much of the time, such fools exist. There's thus a

sizable "optimism premium" in many markets. When

that optimism premium goes away, we're back to the basics

- assets and dividends. We are seeing that now.

|

| Q2

2002 |

| 2002-06-28

- The Worldcom mess |

|

More

phony numbers. Another collapse. Another Andersen audit client,

too.

We predicted

the dot-com collapse. That was easy. The dot-coms had terrible,

but mostly honest, numbers, and ordinary fundamental analysis

worked well on them. Now we're seeing companies go under that

had reported good numbers, but were lying. Reading the financial

statements doesn't help if they're bogus.

There

is no investment without honest reporting. There is only speculation.

In the current reporting environment, one could argue that

pension funds and others with fiduciary responsibilities shouldn't

be in stocks at all.

|

| 2002-06-24

- Where's the bottom? |

|

|

Fifty

years of the Standard and Poor 500 Index

|

There's

the bubble. For half a century, through boom and recession,

the S&P 500 (the broadest of the widely-followed indices)

stayed in a trading range around a long term trend. Until

the late 1990s. This gives a sense of how broad-based the

"irrational exuberance" was. It wasn't all tech

stocks.

The market

top of 2000 was about fifteen years too early. And we're still

well above the historical trend, even after the collapse.

The basic

fundamentals also indicate that the market as a whole is still

far overvalued. Historical price/earnings ratios over the

decades average around 16. The Economist says that U.S. companies

are averaging a P/E of around 40 now.

The bottom

is a long way down from here.

|

| 2002-06-22

- Rite Aid CEO indicted |

|

The Washington

Post reports that the former chairman and chief executive

of Rite Aid Corp was indicted on Federal charges of inflating

the company's earnings, destroying evidence, tampering with

a witness and secretly moving millions in company funds to

a personal side business. Rite Aid stock, around 50 at its

peak two and a half years ago, is now down to 3. Yet again,

we see how criminal activity led to the collapse.

|

| 2002-06-15

- Andersen guilty |

|

Arthur

Andersen LLP was convicted of obstruction of justice today.

The accounting firm that made the Enron mess possible will

soon be history. But the individuals responsible remain at

large. None of the principals of Enron or Andersen are in

jail. Some of them should be.

Jail

is a highly effective deterrent against corporate crime. Executives

are good at insulating themselves from losses at their companies.

It takes prison sentences to get the message through that

society will not tolerate illegal acts by management.

|

| 2002-06-09

- The coming wars |

|

The

current adminstration proposes to start wars. "The

Bush administration is developing a new strategic doctrine

that moves away from the Cold War pillars of containment and

deterrence toward a policy that supports preemptive attacks

against terrorists and hostile states with chemical, biological

or nuclear weapons." This is a great change in American

foreign policy. Never before has such an aggressive policy

been proposed at the Presidential level.

|

| 2002-05-30

- National Coverup Month |

|

This

was a big month for failed coverups. The big ones:

Investigations

continue

in the Wall Street recommendations scam, mentioned last month.Merrill

Lynch settled for $100 million.

Reports

of inflated earnings by major companies continue to surface.

Boeing and Global Crossing are some of the most prominent,

but the list is long. The proposed reform measures are probably

insufficient to get honest numbers. Accounting firms can still

consult for the firms they audit, and brokerage houses can

still offer analysis of companies whose stock they sell. Sham

transactions that inflate earnings are still permitted. The

problem has not been fixed.

|

| 2002-04-28

- How the dot-com IPO boom was fueled by a huge scam |

|

The truth

is starting to come out. Much of the dot-com boom was a scam,

fueled by corrupt investment banks who, in the words of the

San Jose Mercury News, took "kickbacks

from preferred clients in exchange for big allocations of

shares in coveted Internet IPOs." The SEC is investigating

Morgan Staley, Goldman Sachs, J.P. Morgan, Robertson Stephens,

and others for "laddering",

a market manipulation scheme designed to inflate stock prices

immediately after the IPO. This may turn out to be the biggest

"pump

and dump" scheme of all time.

New York

State Attorney General Elliot Spitzer is widening his investigation.

The Securities

and Exchange Commission, the New York Stock Exchange, the

National Association of Securities Dealers, the North American

Securities Administrators Association, and a number of states

are now

investigating. This

could be bigger than Enron and Andersen.

Some

of the companies involved, such as VA Linux, were mentioned

on our Deathwatch or Misery

Row. Those first-day runups were suspicious at the time.

Now it's becoming clear what was going on.

|

| 2002-04-10

- Merrill Lynch stock ratings phony |

|

New

York State Attorney General investigation of Merrill Lynch

"As

part of a quid pro quo between the firm and its investment

banking clients, Merrill Lynch analysts skewed stock ratings,

giving favorable coverage to preferred clients, even when

those stocks were dubious investments. This problem and other

conflicts of interest are revealed by internal e-mail communications

obtained during the investigation by the Attorney Generalís

office. These communications show analysts privately disparaging

companies while publicly recommending their stocks. For example,

one analyst made highly disparaging remarks about the management

of an Internet company and called the company's stock "a piece

of junk," yet gave the company, which was a major investment

banking client, the firm's highest stock rating."

"This

was a shocking betrayal of trust by one of Wall Streetís most

trusted names." - Elliot Spitzer, New York State Attorney

General.

Which

stocks received phony ratings? The court

affidavit names names. Many of these were on Downside's

Deathwatch.

"Thus,

as previously covered stocks such as Pets.com, Mypoints.com,

Quokka Sports, Webvan, iVillage, Buy.com, 24/7 Media, E-Toys,

Internet Capital Group, and InfoSpace plummeted, sometimes

all the way to zero, retail customers and the investing public

were never advised to sell."

This

may be just the beginning. Subpoenas have been issued to other

securities firms.

|

| |

Q1 2002

| 2002-03-14

- Andersen goes down |

|

Grand

Jury Indictment: THE CHARGE: OBSTRUCTION OF JUSTICE

"On or about and between October 10, 2001, and

November 9, 2001, ... ANDERSEN, through its partners

and others, did knowingly, intentionally, and corruptly

persuade and attempt to persuade other persons, to wit:

ANDERSEN employees, with intent to cause and induce

such persons to (a) withhold records, documents, and

other objects from official proceedings, namely: regulatory

and criminal proceedings and investigations, and (b)

alter, destroy, mutilate, and conceal objects with intent

to impair the objects' integrity and availability for

use in such official proceedings. (Title 18, United

States Code, Sections 1512(b)(2) and 3551 et. seq.)"

"The

shredder at the ANDERSEN office in the Enron building

was used virtually constantly, and, to handle the overload,

dozens of large trunks filled with Enron documents were

sent to ANDERSEN's main Houston office to be shredded."

This

speaks for itself.

|

| 2002-02-04

- Our god can lick your god - film at 11. |

|

Religious

wars are picking up. India is having religious massacres

on a scale not seen since the last days of the Raj.

Israel is shelling Palestinian areas. The Afghanistan

war, which seemed to be over, is heating up. We have

the big ones, the U.S. vs. Iraq and India vs. Pakistan,

as real, near-term possibilities. And that's ignoring

Bush's

"axis

of evil" speech, which adds Iran and North

Korea to the enemies list.

The

big question is whether these separate wars will combine

into a big one. It could happen.

It's

worth remembering that this was bin Laden's stated goal.

|

| 2002-01-22

- Another major bankruptcy |

|

Kmart

went bankrupt today. Largest retail bankruptcy ever,

at $17 billion. The

US is "overstored"; there are far more retail

outlets than are needed. Especially during a recession.

Some of them have got to go.

The

dot-coms are long gone, yet the collapse continues.

The companies that are going bankrupt now are ones that

appeared in reasonably conservative portfolios a year

or two ago. The effect on pension funds could be substantial.

|

| 2002-01-12

- Largest bankruptcies of 2001 |

| Company

|

Bankruptcy

Date |

Total

Assets

Pre-Bankruptcy |

| Enron

Corp. |

2001-12-02

|

$63,392,000,000 |

| Pacific

Gas and Electric Co. |

2001-04-06

|

$21,470,000,000 |

| FINOVA

Group, Inc., (The) |

2001-03-07

|

$14,050,000,000 |

| Reliance

Group Holdings, Inc. |

2001-06-12

|

$12,598,000,000 |

| Federal-Mogul

Corp. |

2001-10-01

|

$10,150,000,000 |

Source:

BankruptcyData

Enron

appears to be the largest corporate bankruptcy of all

time, assuming they actually had $63 billion of assets.

There's some question as to whether the asset figure

for Enron is any more meaningful than the rest

of the numbers in their 10-Q. Press reports indicate

considerable "creative accounting", if not

outright fraud.

There

is talk of a crackdown on auditing firms. Believe it

only if Andersen, Inc. is forced to exit the accounting

profession or some of its principals do jail time.

Note

that none of the companies listed were "dot-coms".

Although dot-coms saw declines in market cap on that

scale, the dot-coms never had enough assets to make

this list.

|

| 2002-01-06

- New features for 2002 |

|

Downside

now offers a daily update of the latest 10-K, 10-Q,

and related filings with the U.S. Securities and Exchange

Commission. Today's new filings appear at the left of

this page. Click on any company name shown for the latest

balance sheet and income statement.

The

search box at the top returns the income statement and

balance sheet for any company filing with the SEC.

The

new, calmer, color scheme helps to reduce stress when

reading financial statements of companies in trouble.

|

| |

|

Q4 2001

|

| 12.31.2001

- Ä day |

|

Today Europe switches to a common currency. While

the exchange rates between the European currencies

have been locked together for a year, and accounting

has been in Euros for some months, today is the

practical, and psychological, moment at which

the national currencies disappear. Some of the

national paper currencies do have to be exchanged

within a limited time, so if you have a cash hoard

in some European currency, it's time to convert.

|

|

| 12.27.2001

- Instant Financials |

|

Try our new Financial Statement Search. Enter

a company name or NASDAQ ticker symbol in the

box at the top of the page. We look up the latest

balance sheet and income statement from the company's

SEC filings. Updated directly from the SEC database.

The financial extraction system is under development.

Please let

us know of any problems.

This

is a free service of Downside, offered for casual

use. If you need high-volume access to this data,

please contact us.

|

|

| 12.25.2001

- Bah, Humbug! |

|

Holiday shopping is over. We now return to our

regularly scheduled depression.

We

have two major wars coming up: India vs. Pakistan,

and U.S. vs. Iraq. What happens in 2002 will depend

more on whether those two are avoided than on

any economic factors. We're still in a period

where politics trumps economics.

|

|

| 11.28.2001

- The Internet Depression |

|

"The

Internet Depression", by Michael Mandel,

is the first good analysis we've seen of the aftermath

of the Internet bubble. It's by someone who saw

it coming (the previous hardcover edition, from

mid-2000, was titled "The Coming Internet

Depression"), so he has credibility. A key

point is that there's no Next Big Thing on the

near-term horizon to get the high-tech portion

of the economy out of the tank. He's probably

right. Recommended reading.

|

|

| 11.26.2001

- U.S. officially in a recession |

|

Now it's official. The National

Bureau of Economic Research announced today

that the U.S. recession began back in March, 2001.

These official announcements of recessions trail

reality by at least six months: "The Bureau

waits until the data show whether or not a decline

is large enough to qualify as a recession before

declaring that a turning point in the economy

is a true peak marking the onset of a recession."

This announcement shouldn't surprise anybody

who's been paying attention.

|

|

| 11.04.2001

- Wars with non-state actors |

|

In the post Cold War era, most wars so far have

involved parties other than nation-states. The

developed world has a hard time dealing with such

wars. We recommend reading USMC

Doctrinal Publication 3, "Expeditionary Operations"

which

was written by people who deal with small, messy

wars on a daily basis. Issued in 1999, "Expeditionary

Operations" outlines the post-Cold War situation

in brutal clarity: "While threats to national

security may have decreased in order of magnitude,

they have increased in number, frequency, and

variety. These lesser threats have proven difficult

to ignore. The main point of this discussion is

to point out that the post-Cold War geopolitical

situation has fundamentally altered the nature

and scope of future military conflicts. This situation

requires a diverse range of military methods and

capabilities for effective response. Far from

creating a new world order, the end of the Cold

War has led to what former United Nations Secretary-General

Perez de Cuellar has described as the new

anarchy." Chapter I of "Expeditionary

Forces" provides more insight into the current

situation than most of the talking heads on TV

today.

Despite

the war, it's important to bear in mind that the

current economic troubles stem more from the collapse

of the bubble than the external threat. The dot-com

collapse alone erased more than $1.7 trillion

in shareholder value. The attacks on the U.S.

did far less financial damage.

|

|

|

Q3 2001

|

| 9.21.2001

- Crusading |

|

In

recent years, economics has driven U.S. politics.

Now, politics is driving economics. Worse, to

some extent religion is driving politics. On both

sides. Historically this leads to bad political

decisions. The

history of the Crusades is relevant. From

the call for a crusade by Pope Urban II in 1095

AD, through three bloody but indecisive Crusades,

until the peace agreement between Richard the

Lion-Heart and Saladin in 1192, almost a century

elapsed. And that agreement didn't hold; there

were four more Crusades, the last ending in 1291

AD. The Crusades were two centuries of intermittent,

indecisive bloodshed.

There's

a good reason that successful modern democracies

are secular states.

|

|

| 9.18.2001

- Overreaction |

|

Fundamentals

haven't changed substantially in the last week.

All that's happening is that the air left over

from the overinflated boom is coming out faster

than before. Stocks are overpriced when they're

valued at more than the present value of their

future dividends, remember. All else is based

on the assumption there's a "greater fool"

out there. We won't have many of those around

for a while.

Airline

lobbyists are calling for a federal bailout of

the airline industry. That's corporate welfare,

not disaster recovery.

|

|

| 9.12.2001

- This is a disaster. But it's not a financial disaster. |

|

Bear

in mind that the events of the last two days destroyed

far less dollar value than the dot-com collapse.

This will not have a major, direct economic effect.

The political and social fallout, however, will

be significant.

We're

entering a serious, perhaps grim, period. Substance

will matter more than style. We now have a tough-minded

decade ahead, like the 1950s. The 1950s were a

period of progress, but with a repressive tinge.

We may see both progress and repression again.

We

may, in time, look back on the last 20-30 years

as a golden age.

|

|

| 8.31.2001

- The world is in recession |

|

The

Economist (August 25-31, p. 22) now agrees

we're in a recession. Worldwide, not just the

US. Their outlook is gloomy: "Perhaps

the biggest downside risk is that American share

prices still look overvalued." The

Dow fell through 10,000 this week. The US government

budget surplus is gone. The irrational exuberance

is over.

Forbes

reports signs of a crash in housing. (Commercial

real estate is already at the see-through office

building stage.) The big run-up in house prices

of the late 1990s is starting to run down. It's

not clear yet how severe this will be.

|

|

| 7.17.2001

- Doerr takes it back |

|

John

Doerr has publicly taken back his widely quoted

remark about this bubble being the "largest

single legal creation of wealth in history."

A bit late. Hype is not wealth creation. Wealth

creation requires profits.

Some

of the companies on Deathwatch have, in the last

few weeks, reached the final stage of collapse

- the liquidation auction. It's a great time to

buy slightly used office furniture.

|

|

|

Q2 2001

|

| 6.24.2001

- Deathwatch cleanup |

|

Deathwatch

remains as a historical record of the dot-com

bubble. We've now using NASDAQ charts instead

of Stockmaster charts, which changes the appearance.

NASDAQ charts, unfortunately, are not available

once trading in a stock has ceased, so when a

company is gone, its chart goes blank. This is

a lack; it's important to remember the dead and

not repeat their mistakes.

The predictions remain frozen as of January 1,

2001.

A

new, improved Deathwatch is coming. Watch for

further announcements.

|

|

| 6.17.2001

- Summer power crisis |

|

|

When

the red line reaches the green line, California

goes dark.

This

is a nice illustration of the nature and

limitations of markets. Markets don't reach

equilibrium; they vary around it. In a market

like electricity, where there's no inventory

and adding capacity takes years, the variations

are huge. There's no surprise here. This

is how systems with negative feedback and

delay behave. Utilities were run on a regulated

rate-of-return basis for a century, damping

out volatility at some cost in excess capacity,

until some politicians forgot this.

Live

data at left from the California

Independent System Operator.

|

|

|

| 4.14.2001

- One year ago on Downside |

|

Downside

is one year old today. Here's what we said a year

ago when we started Downside:

"All

bubbles burst. This one just did. The great

Internet bubble is over.

First

we had Internet companies with no profits. Then

we had Internet companies with no revenue. Towards

the end, we saw attempts to take public Internet

companies with no operations. It had to end,

and it just did.

This

is healthy. It's not the end of the Internet,

just the end of the stupidity. Now we have to

get through a return to reality. "Reality",

in this context, is a return to historical P/E

ratios, in the 6 to 20 range. What about the

companies with no earnings? Uh oh. Losing money

on every sale and making it up on volume is

a joke, not a business plan."

Any

questions?.

|

|

| 4.12.2001

- "101 dumbest moments in E-business history" |

|

"eCompany

Now" has a list of the 101

dumbest moments in E-business history. Items

on the list go back to 1997. Of course, it would

have been more useful if these items had been

reported as dumb before the bubble collapsed.

We

have removed "Dot Com Failures" from

the list of resources in the toolbar at the left

because that site has disappeared. Also,

"Stock Detective" hasn't been updated

much since its acquisition by FinancialWeb.

Only

4846 NASDAQ symbols today. The failed dot-coms

are being flushed out of the system.

|

|

| 4.7.2001

- Aftermath of a bubble |

|

With

the NASDAQ at 1720, and no bottom in sight, it's

worth looking back at other bear markets. In the

Great Depression of the 1930s, it took 25 years,

(and World War II) before the DJIA again reached

its 1929 high. The Nikkei

has been below its 1989 peak for over a decade,

and is still down over 60% from that high. That's

what the aftermath of a bubble looks like. Recovery

takes decades, not months.

There

are only 4864 NASDAQ symbols today, down from

5021 at the beginning of the year. The shakeout

continues.

|

|

|

Q1 2001

|

| 3.13.2001

- NASDAQ index below 2000 |

|

The

NASDAQ index is down 62% from its all-time high.

The

NASDAQ's home

page says today: "A good company before

yesterday's selloff is probably a good company

today--but it pays to diversify. Money market

and certificate of deposit accounts remain safe,

profitable havens."

Better

late than never.

We're

freezing our Deathwatch

predictions at where they were on January

1, 2001. This lets everyone see how the bubble

plays out. The charts and notes will continue

to be updated as the collapses, bankruptcies,

mergers, and delistings continue.

|

|

| 2.15.2001

- NASDAQ below 5000 symbols |

|

Lately

we've been monitoring the number of ticker symbols

on the NASDAQ. It's at 4952 today, down from 5021

at the beginning of the year. That's a big drop

for six weeks. Many more will follow. Companies

with stock prices below 1 are kicked down to the

pink sheets, in accordance with the NASDAQ rules,

and there are all too many of those among the

one-time high flyers.

Many

of those companies should never have been listed

on a major exchange.

|

|

| 1.10.2001

- Corporate whining about Deathwatch |

|

We've

been hearing complaints recently from some companies

mentioned in Deathwatch. The main complaint is

that Deathwatch is harsh on companies writing

off big non-cash items. On request, we'll put

a note on Deathwatch for companies where this

is an issue. But we're not going to adjust the

death date manually. Deathwatch is automated;

we don't make judgement calls about it. Income

is "Net Income" from the income statement;

cash is "Cash" from the balance sheet.

The death date is computed from those two numbers.

It's simplistic, but free of spin control.

The

loudest complainer's stock is down 98% over the

last year. Their stockholders have our sympathy.

|

|

|

Q4 2000

|

| 12.24.2000

- Time off for Xmas Eve? Bah! Humbug! |

|

The

EDGAR database at the U.S. Securities and Exchange

Commission is broken today. Both the forms search

engine and filing retrieval by known URL are failing.

Looking up Microsoft's

latest quarterly numbers returned "page

not found". The forms search engine can't

find General Motors, Microsoft, or Cisco. Not

good.

|

|

| 12.18.2000

- The Golden Life Raft - the rule change that made

the Internet bubble possible |

|

Until

the late 1990s, the Securities and Exchange Commission's

Rule 144 generally required that insiders hold

their stock for two years after an IPO. That rule

was changed on February 20, 1997 to allow insider

sales much sooner. The boom in dumb IPOs followed

shortly thereafter. Under the old rule, if the

company tanked months after the IPO, management,

and the venture capitalists, went down with the

ship. The new rule provides a "golden life

raft", allowing management and the VCs to

cash out and watch from safety while the ship

goes down without them.

It's

instructive to read the position

of the National Venture Capital Association,

the VC's trade association, when they were lobbying

for this change: "The NVCA supports a

further shortening of this holding period. This

further shortening would enable venture capital

funds to provide faster liquidity to fund investors,

thereby increasing their returns and attracting

more capital for investment in emerging growth

companies." This is financial-speak for

"let's party".

That

single rule change made the bubble possible. In

retrospect, making insider sales easier was terrible

public policy. The only people who benefit are

those doing IPOs that shouldn't have been done

at all.

|

|

| 12.11.2000

- Housekeeping and corrections |

-

Kanakaris Wireless (KKRS) is showing on

Deathwatch with the ticker symbol and chart

of Kana Corporation (KANA). The death date shown

applies to Kanakaris Wireless. This will be

fixed in the next update cycle.

- Salon's

latest 10-Q filing with the SEC contains inconsistent

data affecting Deathwatch. Salon has been informed.

We've added a note to Salon's entry on Deathwatch.

- The

charts on Deathwatch now cover 12 months instead

of 6, so you can see how overpriced Deathwatch

stocks were in their heyday.

|

|

| 12.9.2000

- This isn't the first time |

|

"When the going is good and new issues are

readily salable, stock offerings of no quality

at all make their appearance. They quickly find

buyers; their prices are often bid up enthusiastically

right after issuance to levels in relation to

assets and earnings that would put IBM, Xerox,

and Polaroid to shame. Wall Street takes this

madness in its stride, with no overt efforts by

anyone to call a halt before the inevitable collapse

in prices. (The SEC can't do much more than insist

on disclosure of information, about which the

speculative public couldn't care less, or announce

investigations and mild punitive actions of various

sorts after the letter of the law has been clearly

broken.) When many of these minuscule but grossly

inflated enterprises disappears from view, or

nearly so, it is all taken philosophically enough

as "part of the game." Everybody swears

off such inexcusable extravagances - until next

time." -- Benjamin Graham, in his The

Intelligent Investor, p. 216. Sound like the

current market? That was written in 1973. If this

surprises you, buy

the book; you need it.

|

|

| 12.5.2000

- Recent bankruptcies |

|

TSR

Wireless (privately held) went

bankrupt today, leaving several million pagers

without service. Chapter 7 liquidation. It's a

serious problem when an infrastructure company

goes under. Customers of companies in trouble